January 16, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 | |

Sanderson Farms, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

January 16, 2018

| Letter from the Chairman and Chief Executive Officer |  |

Dear Stockholder:

The 2018I am pleased to invite you to attend Sanderson Farms’ annual meeting of stockholders on February 18, 2021. Because of the Companypublic health impact of the COVID-19 pandemic, the meeting will be held inexclusively online via a live internet webcast. There will be no physical meeting. The “virtual-only” meeting will also allow for greater participation by our stockholders, regardless of their geographic location. Details about the Multi-Purpose Room of the Company’s General Corporate Offices in Laurel, Mississippi, at 10:00 a.m. Central Time on Thursday, February 15, 2018. Thetime and purposes of the annual meeting and how to access it online are set forthcontained in the accompanying Noticeenclosed proxy statement and Proxy Statement.notice of the meeting.

We will miss greeting you in person, but we are taking this step to protect the health and wellness of our stockholders, directors, employees, and guests. We are excited to embrace the latest technology to provide expanded access, improved communication, and cost savings for our stockholders.

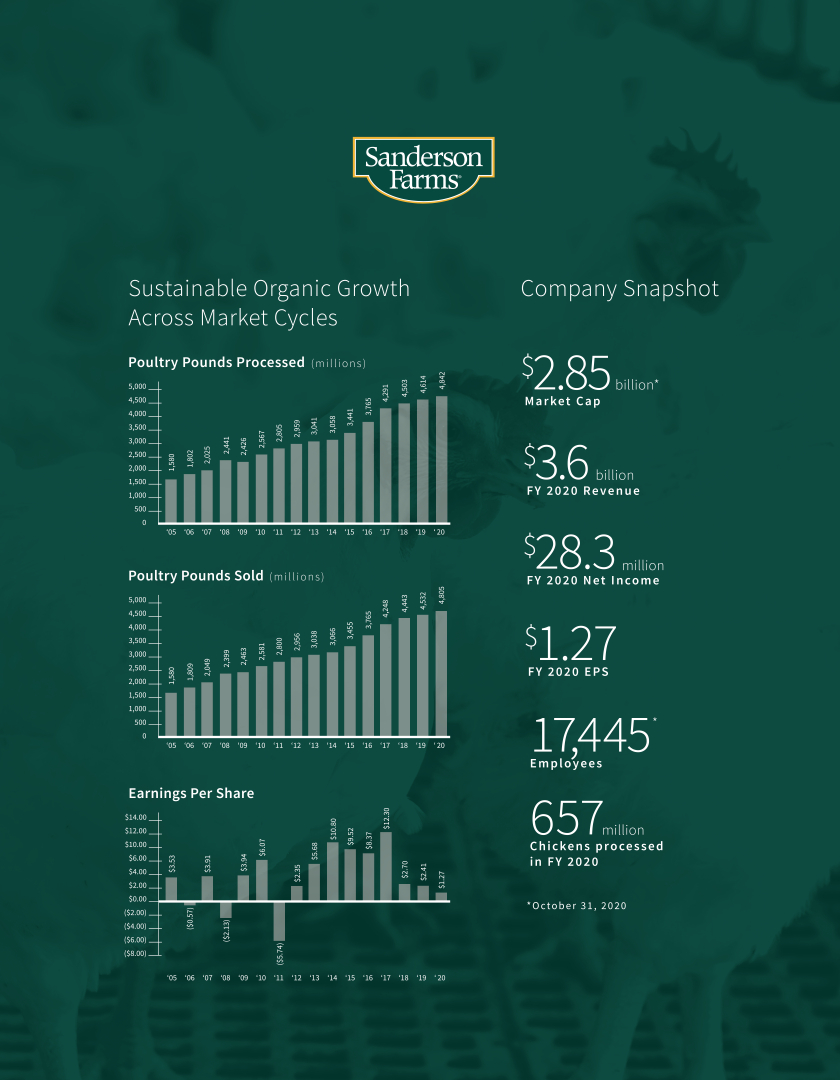

Without question, 2020 was an extraordinarily challenging year. The 2017 Annual Report, which is enclosed, contains financialpandemic, the social and other information concerningracial unrest in our nation, high levels of unemployment, and a global recession presented conditions we have never experienced in our company’s 73-year history. But we managed the Company and its business forwell by staying true to our core values. The welfare of our 17,445 employees has been our first consideration in every decision we have made throughout the fiscal year ended October 31, 2017. The Annual Report is not to be considered part of the proxy solicitation materials.pandemic.

We cordially inviteare pleased to provide you information in this proxy statement on the steps we took to protect our people from COVID-19. We also present information about our efforts to maintain a safe workplace and promote diversity, equity, and inclusion throughout our company.

Our Board believes that it is essential to have an ongoing and open dialogue with our stockholders, especially as we navigate challenges like those presented this year. In 2020, we met in person or virtually with stockholders holding approximately 55% of our stock. As a direct result of our stockholder engagement, we adopted the Sustainability Accounting Standards Board (SASB) reporting framework for our 2019 Corporate Responsibility Report. You can read more about our stockholder engagement program in this proxy statement.

It is important that your shares be represented and voted at the annual meeting. Whether or not you plan to attend the virtual-only annual meeting. Ifmeeting online, we encourage you cannot attend, please complete and return the enclosed proxyto vote your shares using one of the voting methods described in this proxy statement.

Thank you for your support and continued ownership of Sanderson Farms.

Cordially,

Joe F. Sanderson, Jr.

Chairman and Chief Executive Officer

Letter from the Lead Independent Director Dear Fellow Stockholders: On behalf of the Board of Directors, I am privileged to share some of the ways the Board worked to provide strong governance and independent oversight of Sanderson Farms during 2020. COVID-19 From the outset of the pandemic, the Board was focused on its oversight and risk management responsibilities. We met every week between March 13 and |  |

June 5, then every other week or as needed, to receive reports from our executive leadership about management’s response to the enclosed materials sopandemic, working conditions for our employees, and the effect on the Company’s operations and sales. We are tremendously proud and grateful to our employees who have worked tirelessly to keep our operations running throughout the crisis and maintain a stable food supply for our country. Additionally, the pandemic has demonstrated without a doubt that your votewe have the most dedicated and conscientious management team in the industry. Their commitment to the safety and welfare of our employees has never wavered. At the same time, they have done an outstanding job of leveraging the flexibility of our operations to shift the Company’s production to serve customers experiencing significant changes in demand for poultry products. The Board is grateful for the team’s leadership, stamina, and resolute focus on building long-term shareholder value while adhering to our core value of respect for every member of our team.

Diversity, Equity, and Inclusion

The Board cares deeply about racial equity and recognizes that while Sanderson Farms can be recorded.proud of its long history promoting diversity, equity, and inclusion (DEI), there is always more we can do in this area. In 2020, the Board appointed a special committee to provide Board-level oversight of DEI in the Company. The committee’s first task was to engage an outside consultant to conduct a top-to-bottom review of our policies and practices on DEI.

Stockholder Engagement and Corporate Governance

In the Fall of 2020, the three standing Board committee chairs and I once again joined senior management in meetings with our stockholders. We thank those of you who met with us and gave us valuable input on our governance practices and other matters. We reaffirm our commitment to strong corporate governance and to rigorous, independent Board oversight. Throughout a year marked by urgency, the Board and its committees continued to guide and direct management, including on the major, ongoing risks we face.

Succession Planning

Planning for management and director succession is one of our most important duties, and we continued during 2020 to meet this responsibility. Directors had numerous opportunities to engage with Company managers who are potential future leaders and received feedback from the officers about managers who could be candidates to succeed them. Additionally, the Board continues to assess the skill sets represented on the current Board and identify gaps that can be addressed through regular board refreshment.

In 2021, the other directors and I are committed to maintaining diligence in overseeing the Company’s performance, risk management, and investment in our people and communities. We look forward to your participation at our virtual annual meeting and thank you for your support of Sanderson Farms.

Cordially,

|

Phil K. Livingston

Lead Independent Director

SANDERSON FARMS, INC.

P.O. Box 988

Laurel, Mississippi 39441

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE | 10:00 a.m. Central Time on Thursday, February | |

PLACE | The | |

ITEMS OF BUSINESS |

| |

RECORD DATE | You can vote if you were, or if a nominee through which you hold shares was, a stockholder of record on December | |

ANNUAL REPORT AND PROXY STATEMENT | Our | |

PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card sent to you. Most stockholders also have the options of voting their shares by proxy on the | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 15, 201818, 2021

The Notice of Annual Meeting of Stockholders, the Proxy Statement,proxy statement, and our 20172020 Annual Report are also availableon-line at:

http://ir.sandersonfarms.com/annual-proxy.cfmfinancial-information/annual-reports

BY ORDER OF THE BOARD OF DIRECTORS:

Timothy F. Rigney Secretary |

TABLE OF CONTENTSProxy Statement Summary

This summary provides highlights of information in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting your shares. For more complete information regarding the Company’s 2020 performance, please review the Company’s Annual Report on Form 10-K for the year ended October 31, 2020. The Notice of the Annual Meeting of Stockholders, this proxy statement, the accompanying proxy card, and our 2020 Annual Report were first sent or given on or about January 14, 2021, to stockholders of record as of December 22, 2020, which is the record date of the annual meeting.

Annual Meeting Information

DATE & TIME Thursday, February 18, 2021 10:00 a.m. – Central Time | LOCATION The meeting will be held exclusively online at www.meetingcenter.io/253485236. There will be no physical meeting this year. See “Attending the Annual Meeting” on page 74. | RECORD DATE You can vote if you were, or if a nominee through which you hold shares was, a stockholder of record on December 22, 2020. |

Summary of Matters to be Voted Upon at the Annual Meeting

The following table summarizes the items that will be brought for a vote of our stockholders at the meeting, along with the Board’s voting recommendations and the required vote for approval.

Proposal No. | Description of Proposal | Required Vote for Approval | Board’s | |||||||||

1 | To elect four director nominees For more information, see page 2. | For each director, a majority of the shares present in person or by proxy and entitled to vote | FOR Each Nominee | ✓ | ||||||||

2 | To approve, in a non-binding advisory vote, the compensation of our named executive officers For more information, see page 64. | Majority of the votes cast | FOR | ✓ | ||||||||

3 | Ratification of the appointment of Ernst & Young LLP as our independent auditors for fiscal 2021 For more information, see page 65. | Majority of the votes cast | FOR | ✓ | ||||||||

4 | Stockholder proposal requesting report on the Company’s human rights due diligence process, if presented at the meeting For more information, see page 67. | Majority of the votes cast | AGAINST | X | ||||||||

Sanderson Farms | 2021 Proxy Statement i

Environment, Social, and Governance (ESG) Strategy

ESG Highlights—2020

The events of 2020 and our Company’s response show without doubt the importance of our ESG philosophy and how that philosophy sets us apart from our industry peers. Our approach to ESG matters is deeply rooted in our corporate culture and the core values that have motivated us since our founding in 1947. The cornerstone of our culture and values is respect for the inherent dignity, equality, and worth of every human being. This respect is the driving force behind everything we do at Sanderson Farms, and we believe it is a key reason for our company’s success over the past 73 years.

The first document in our company policy manual is our Statement of Philosophy, initially drafted in 1969. The Statement emphasizes that we cannot be successful unless we first meet our responsibility to our employees. It explicitly reminds us that every employee has rights that we must respect before we can expect the performance necessary to reach our high standards. Chief among these are the rights to a safe workplace and to fair and equitable treatment.

We are pleased to showcase in this year’s proxy statement our efforts to protect our employees during the COVID-19 pandemic, maintain a safe workplace, and promote diversity, equity, and inclusion in our organization. You can read more about our ESG programs in our most recent Corporate Responsibility Report which is located on our website at http://ir.sandersonfarms.com/corporate-governance.

“We at Sanderson Farms believe in the respect for the dignity of each individual. This principle should influence our decisions in all relationships with employees, customers, suppliers, contract producers, and citizens.” —Excerpt from Sanderson Farms Statement of Philosophy |

Sanderson Farms | 2021 Proxy Statement ii

COVID-19

In February 2020, we formed a COVID-19 response team of senior managers, including our CEO, President and CFO, to coordinate our company’s response to the pandemic and manage and mitigate related risks. Our top priority throughout the crisis has been protecting the health, safety, and welfare of our employees.

Without concern for the impact on our profits, we have invested millions in protecting our employees from COVID-19 by proactively taking the steps highlighted below. We believe our proactive approach is the reason that we have been able to maintain a relatively low rate of infections among our employees.

OUR COVID-19 SAFETY MEASURES

| ● | In February 2020, we began consulting with specialists in infectious disease and epidemiology, including an infectious disease expert who toured our facilities, and we have continued to consult with experts in these fields throughout the pandemic. As a result of our early consultations and facility tours, we developed and implemented a COVID-19 safety plan. Through our ongoing consultation with experts, we continually assess the effectiveness of our plan and make changes as needed. We also frequently communicate with state and local officials and health departments regarding our practices. |

| ● | We implemented strict personal and work-related travel and public gathering restrictions for all of our employees, contractors and members of their households. |

| ● | We set up on-site medical clinics at each of our processing plants. The clinics are staffed by third-party medical personnel who provide telemedicine visits, flu and coronavirus tests and flu vaccinations at no cost to our employees. |

| ● | We provide information about coronavirus and measures to reduce the risk of contracting and transmitting the virus on video displays throughout our facilities and on our employee mobile app. We have also provided live training sessions about the virus to our hourly employees. Each of these communications is provided in the languages spoken by our employee population. |

| ● | We have created an internal hotline monitored by our nurses at our general corporate offices that employees may call to ask questions or voice concerns about the virus. |

| ● | Non-essential visitors may not enter our facilities. |

| ● | We are taking the temperature of everyone entering our facilities. Anyone with a temperature of 100°F or higher is denied entry. Employees denied entry are sent home with pay and are asked to contact their healthcare provider. |

| ● | Our company nurses have received specialized training on identifying COVID-19 symptoms. Employees exhibiting symptoms while at work are immediately sent home with pay and are asked to contact a healthcare provider immediately. Nurses also have front-line level personal protective equipment. |

| ● | Employees who test positive for COVID-19, those who live in the same household as someone who has tested positive, and those who work in close proximity to an employee who has tested positive are sent home to isolate or self-quarantine with pay. The specific isolation or quarantine period varies based on individual circumstances but generally ranges from 10 to 24 days. |

| ● | We continuously look for commonalities among our employees who test positive, including geographic concentrations in their places of residence, so we can reduce or prevent the spread of the virus in our facilities. |

Sanderson Farms | 2021 Proxy Statement iii

| ● | We sent home for 14 days, with pay, approximately 400 employees who work in our Moultrie, Georgia, facility and are residents of a nearby county that experienced a high rate of community infections. |

| ● | We are providing and requiring employees, United States Department of Agriculture inspectors, and essential visitors to wear face masks and face shields. Anyone on the premises of our processing plants, feed mills, hatcheries, and vehicle maintenance shops is required to wear this equipment. Where an employee’s job function does not permit him or her to wear a face shield, we require the employee to wear safety glasses. |

| ● | In areas of our facilities where space allows, we require social distancing, and in areas where equipment configurations allow, we have installed physical barriers between work stations. Where social distancing or the installation of physical barriers is not achievable, the use of face shields is mandatory. Additionally, we have optimized ventilation throughout our facilities to mitigate the risk of exposure to the virus. We are also providing and requiring employees and essential visitors at our general corporate offices and our laboratory to wear face masks while in common areas and in instances where social distancing is not achievable. |

| ● | We require employees to practice social distancing on breaks and have staggered break times to reduce the number of people in break areas at any one time. We have installed physical partitions in our break rooms to provide barriers between employees and have erected tents outside of our facilities to provide employees with more space during breaks. |

| ● | We have installed additional hand sanitizer stations appropriate for use in food processing facilities at all our facilities. |

| ● | A third-party sanitation service provider performs an antiviral sanitation process at each of our facilities at least weekly, and we have increased the frequency of cleaning common areas and frequently touched surfaces. |

| ● | Salaried employees who are considered to be at high risk for severe illness from COVID-19 are permitted to work from home if their job duties allow for remote work. |

| ● | In November 2020, we adopted a policy to send home for two weeks, with pay, employees age 65 or older who work at locations where the number of positive coronavirus cases as a percentage of total employees at the location reaches a certain threshold. This has been triggered at only one location since we adopted the policy. |

| ● | We have closed our company-owned childcare facility in Collins, Mississippi until further notice. |

| ● | In certain of our facilities in communities that experienced high infection rates, we cooperated with local health authorities or determined on our own to test all our employees at the facility for coronavirus. Employees who tested positive were sent home with pay until permitted to return to work under our isolation policy. To date, we have performed five facility-wide tests resulting in positivity rates per employee tested of 3.3%, 0.5%, 5.8%, 3.3% and 7.3%. |

Recognizing the hardships that the pandemic and the resulting economic recession have imposed on many of our employees, we also provided the following assistance:

| ● | As a food producer, we have been designated by the federal government as part of the United States’ critical infrastructure with a special responsibility to continue operations. From late-March |

Sanderson Farms | 2021 Proxy Statement iv

2020 through mid-September 2020, we paid our hourly employees who worked all their scheduled hours during a week an attendance bonus equal to $1.00 per hour. |

| ● | We enhanced our health plan to provide for 100 percent coverage of testing and treatment of COVID-19 at no cost to plan participants. |

| ● | We provided detailed guidance to our employees on the steps to take to ensure timely receipt of the stimulus payment provided under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). |

| ● | We distributed written materials to our employees in all languages appropriate for our employee population to inform them about COVID-19 risks and encourage good personal hygiene, cleaning and social distancing practices away from work and when carpooling to work to protect themselves and their families. |

| ● | We have given our employees free bottles of hand sanitizer that they may refill from supplies at our facilities and washable masks for them and their families. |

| ● | We have given free, 10-pound boxes of fresh chicken to our employees in connection with several holidays. |

| ● | Because demand for the products we produce at our prepared chicken facility significantly decreased during the early stages of the pandemic, we ran fewer shifts at that facility. We assisted our employees at the plant in filing for unemployment benefits due to their reduced work hours. |

Our Record for Workplace Safety

Our COVID-19 safety measures supplement our robust policies and practices that have made us one of the safest companies in our industry. Our occupational health and safety programs are overseen by our President’s safety committee, which meets quarterly to set specific goals for workplace safety and measure attainment of those goals. Even though we have built more poultry complexes than any other company in the U.S. since 1993 and hired an additional 13,000 employees, our OSHA injury rates have declined by 67 percent during that time.

| ● | For fiscal year 2019, we set a goal to reduce our OSHA injury rates by 10 percent compared to 2018, and we exceeded that goal, with rates declining by over 21 percent. |

| ● | In fiscal 2020, our OSHA injury rates declined another 6.3 percent compared to 2019. Cumulatively for the five years ended October 31, 2020, we had the fewest OSHA citations per 1,000 employees of any company in our industry having more than 5,000 employees. |

| ● | We have five in-house, certified safety professionals, and employees are trained extensively on process safety management, lockout/tagout, hazard communication, confined space entry, use of fire extinguishers, and ergonomics. |

| ● | We work closely with ergonomists to continuously monitor our employees’ working conditions and implement measures to ensure their wellness. For example, we have set our processing line speeds at the lowest rate of any company in our industry, and well below maximum USDA-approved line speed of 175 birds per minute (bpm), to reduce employee stress and injuries. |

| ● | We have a strict policy against retaliation for reporting injuries and illness. |

We keep our line speeds at the slowest rate in our industry— 75 bpm to reduce employee stress and injuries. |

Sanderson Farms | 2021 Proxy Statement v

Diversity, Equity, and Inclusion

| ● | A vital part of our strategic plan is maintaining a company culture of mutual respect, collaboration, trust, and fairness among all our team members. We have a strict, written policy prohibiting discrimination based on race, color, religion, gender, pregnancy, disability, medical condition, national origin, ancestry, age, veteran status, marital status, sexual orientation, and gender identity. |

| ● | In addition, we have made diversity and inclusion of women and minorities a top priority at all levels of our company. |

| ● | We believe the culture we have created and imparted to our team is one reason for our high level of employee retention, which has been essential for our significant and successful internal growth over the last 25 years. |

OUR DIVERSITY COMMITTEES

To be the best in our industry and successfully implement our growth plan, we continually strive to attract, develop and retain a high quality and diverse workforce. In 2011, our senior management created a Diversity and Inclusion Committee and charged it to develop a plan to increase the participation of women and minorities in management.

The committee formulated a Diversity and Inclusion Strategic Plan as a framework for identifying and advancing talented job applicants and employees with different backgrounds and life experiences. We believe this initiative is one of the ways that we have created a work environment where differences are understood, appreciated and leveraged, and an atmosphere that inspires innovation, creative thinking, collaboration, and devotion to the success of each other.

The committee is composed of the heads of our three operating divisions—production, processing and sales; our General Counsel; our Director of Administration, who manages our human resource function; and other members of management. The committee’s three, over-arching objectives are to:

| ● | Recruit from a diverse, qualified group of job applicants; |

| ● | Foster a company culture that values inclusion and mutual respect; and |

| ● | Develop processes to make our managers accountable, help measure results, and refine our approach based on the data we gather. |

The committee meets quarterly to review our salaried hiring by location and division, along with trends in diverse hires; our diversity recruitment initiatives; data on the diversity of participants in our management and leadership training programs; the media we use to advertise our job openings and trainee programs and whether they are reaching a diverse pool of potential applicants; and other data. The committee also investigates and reports quarterly to our CEO and other senior officers any under-utilization and/or under-selection of women and minorities among new hires and promotions at each of our locations. The committee makes reports to the Board of Directors from time to time.

In fiscal 2020, the committee formed a new steering committee as a grass roots, action-oriented team to champion positive change.

Among the measures that the Diversity and Inclusion Committee has expanded as a result of its work is our highly successful program targeting recruits at Historically Black Colleges and Universities. We are also building relationships with and targeting universities that have high concentrations of Latinx and Native American students.

Sanderson Farms | 2021 Proxy Statement vi

Also in fiscal 2020, the Board of Directors appointed a special committee of directors on diversity, equity, and inclusion. The committee will provide Board-level oversight of all DEI matters in the Company. The

committee’s first task was to retain an outside DEI consulting firm that will conduct a top-to-bottom review during the first half of calendar 2021 of DEI in our company.

| Our Commitment to Diversity |

| ||||||||||||

| 81% | 48% | 41% | 22% | 42% | 29% |

| |||||||

| Percent of our employees who are racial or ethnic minorities | Percent of our employees who are women | Percent of our management employees who are racial or ethnic minorities | Percent of our management employees who are women | Percent of our top 10% compensated employees who are racial or ethnic minorities | Percent of our top 10% compensated employees who are women |

| |||||||

| As of October 31, 2020 | ||||||||||||||

DEI Training and Reporting

We believe that two reasons for our success at promoting DEI in our company are our training program and the communication channels we provide to employees to report violations of our workplace policies.

| ● | All of our salaried employees are required to attend training sessions each year on diversity and our policies on harassment and discrimination. The training includes a review of the procedures for employees to report harassment and discrimination and makes clear that we do not tolerate any retaliation against employees who report violations. The consequence for an employee who retaliates against another employee for making a complaint is immediate termination. |

| ● | We also review these workplace policies in orientation sessions for newly hired employees as well as in the paid training sessions we require annually for our hourly employees. |

| ● | We instruct employees to report discrimination and harassment immediately to the employee relations manager, division manager or superintendent at the employee’s location. If this is not possible or is inappropriate in the circumstances, employees are encouraged to immediately contact the human resources department at our general offices. |

| ● | If an employee is uncomfortable reporting discrimination or harassment directly to our human resources team, he or she may make an anonymous report through our 24-hour tip line, which is discussed on the next page. |

| ● | We take allegations of discrimination or harassment very seriously and we promptly investigate all reports of this conduct. |

In fiscal 2020, we invested more than $3.3 million in employee training and development. |

Sanderson Farms | 2021 Proxy Statement vii

HOW WE LISTEN TO OUR EMPLOYEES

We greatly value our 17,445 employees and want and appreciate their feedback. In many cases, our direct engagement with our employees has not only allowed us to improve work conditions for our people, but also has helped us solve supervisory problems and inefficiencies in our operations.

We have several processes through which employees can make their voices heard. Our hourly employees must complete three paid hours of training each year. At the end of the training, employees are asked to fill out an evaluation indicating their understanding of the training they received and any comments they wish to make to our senior management on any subject.

We also conduct “intervention interviews” with hourly employees in departments and divisions that have experienced a higher than normal employee turnover rate. Our Organizational Development team holds one-on-one meetings with hourly staff on an anonymous basis to get their perspectives on measures we could take to improve employee retention. For example, the interviews could reveal that a supervisor is not engaging well with the line workers who report to him. With leadership training from our Training staff, the supervisor can address a weakness in his management style, which can lead to greater job satisfaction for his direct reports and advancement opportunities for the supervisor.

Our intervention interviews have also helped us identify instances where our pay levels were not keeping pace with the market as well as opportunities for new employee experiences. Some of these experiences, like our employee family days, have become company traditions.

Our salaried employees have a formalized performance review process in which they complete a self-evaluation about their attainment of their personal goals. In this process, both employees and their supervisors provide feedback on their working relationship. Employees can indicate areas where they feel they were not supported by their supervisor or where they lacked resources to achieve their potential. This feedback is reviewed by the supervisor’s superiors and is used in making salary and advancement decisions.

Finally, all our employees have an anonymous tip line available to them 24 hours a day to report matters which they believe management and the board should be aware of. We advertise the tip line in both English and Spanish in our internal newsletter. The line is a toll-free telephone line that comes straight to Company headquarters on a line with no caller ID. A full, unedited transcript of every single call is given to the Board’s Audit Committee, along with the disposition of the matter raised on the call. While our preference is to dialogue with employees one on one, we recognize there are times when an employee would prefer anonymity.

“We recognize the individual dignity and worth of each employee who is making his [or her] contribution to our common endeavor.” —Excerpt from Sanderson Farms Statement of Philosophy |

Sanderson Farms | 2021 Proxy Statement viii

OUR RESPECT FOR HUMAN RIGHTS Our approach to COVID-19, workplace safety, and racial equity is a direct result of our core values. These values are enshrined in our Company Vision, Statement of Philosophy and Code of Conduct. Most recently we have articulated these values in our Statement on Human Rights, which was adopted by our Board of Directors and our management executive committee. It is intended to meet the framework of the United Nations Guiding Principles on Business and Human Rights. We recognize our responsibility for, and are committed to, the total respect of internationally recognized human rights as expressed by the Universal Declaration of Human Rights and the principles concerning fundamental rights set forth in the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work. We also have a responsibility to avoid causing or contributing to adverse human rights impacts through our activities; to seek to prevent or mitigate such impacts that are directly linked to our operations or products by our business relationships; and to take appropriate action, which may include remediation, when such impacts occur. You can read our Statement on Human Rights on our website at: https://ir.sandersonfarms.com/corporate-governance |

Corporate Governance

Director Nominees and Continuing Directors

Here is a summary of information about our director nominees and directors continuing in office. We have included the Board’s determination about the independence of each nominee and continuing director under the NASDAQ Stock Market listing rules. Our Board is divided into three classes, and directors in a class are elected at our annual meeting to serve a term of three years until their successors are elected.

NOMINEES

Name | Primary Occupation | Term Ending | Age | Director Since | Independent | Standing Committee | ||||||||||||||

AC | CC | NGC | ||||||||||||||||||

Class B | ||||||||||||||||||||

John Bierbusse | Retired Vice President and Manager of Research Administration, A. G. Edwards | 2024 | 65 | 2006 | ||||||||||||||||

Mike Cockrell | Treasurer, Chief Financial Officer and Chief Legal Officer, Sanderson Farms, Inc. | 2024 | 63 | 1998 | ||||||||||||||||

Edith Kelly-Green | Partner, The KGR Group | 2024 | 68 | 2018 | ✓ | FE | C | |||||||||||||

Suzanne T. Mestayer | Owner and Managing Principal, ThirtyNorth Investments, LLC | 2024 | 68 | 2017 | ✓ | | C, FE |

| ✓ | |||||||||||

C = VC = FE = | Chair Vice-Chair Financial Expert | AC = CC = NGC = | Audit Committee Compensation Committee Nominating and Governance Committee | |||||||||||||

Sanderson Farms | 2021 Proxy Statement ix

DIRECTORS CONTINUING IN OFFICE

Name | Primary Occupation | Term Ending | Age | Director Since | Independent | Standing Committee | ||||||||||

AC | CC | NGC | ||||||||||||||

Class C | ||||||||||||||||

Fred L. Banks, Jr. | Senior Partner, Phelps Dunbar LLP | 2022 | 78 | 2007 | ✓ | ✓ | ✓ | VC | ||||||||

Toni D. Cooley | Chief Executive Officer, the Systems Group companies | 2022 | 60 | 2007 | ✓ | VC | ✓ | |||||||||

Sonia Pérez | President, AT&T Southeast States | 2022 | 64 | 2019 | ✓ | ✓ | ✓ | |||||||||

Gail Jones Pittman | Chief Executive Officer, Gail Pittman, Inc. | 2022 | 67 | 2002 | ✓ | ✓ | C | |||||||||

Class A | ||||||||||||||||

David Barksdale | Principal, Alluvian Capital | 2023 | 44 | 2018 | ✓ | ✓ | ✓ | |||||||||

Lampkin Butts | President, Sanderson Farms, Inc. | 2023 | 69 | 1998 | ||||||||||||

Beverly W. Hogan | President Emerita, Tougaloo College | 2023 | 69 | 2004 | ✓ | ✓ | ✓ | |||||||||

Phil K. Livingston

(Lead Independent Director) | Retired Chairman and Chief Executive Officer, Deposit Guaranty National Bank of Louisiana | 2023 | 77 | 1989 | ✓ | VC, FE | ✓ | ✓ | ||||||||

Joe F. Sanderson, Jr.

(Chairman of the Board) | Chairman and Chief Executive Officer, Sanderson Farms, Inc. | 2023 | 73 | 1984 | ||||||||||||

C = VC = FE = | Chair Vice-Chair Financial Expert | AC = CC = NGC = | Audit Committee Compensation Committee Nominating and Governance Committee | |||||||||||||

John H. Baker III, who had been a Class B director since 1994, will retire from the Board of Directors when his term expires at the annual meeting.

Sanderson Farms | 2021 Proxy Statement x

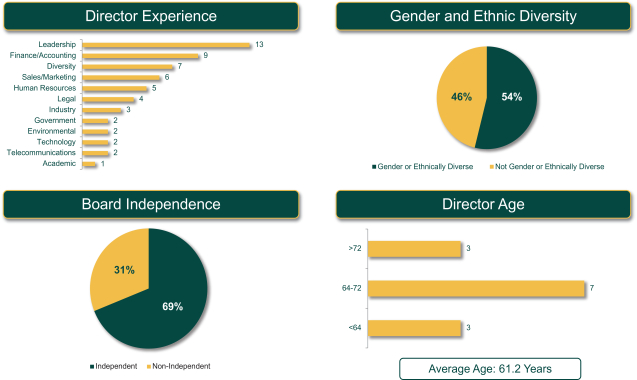

Board of Directors Snapshot

The information below describes the attributes of our Board following the annual meeting, assuming all the nominees are re-elected:

In November 2019, the Women’s Forum of New York recognized us as a Corporate Champion for having over 40 percent of our board seats filled by women. |

Board Highlights

| ● | Strong diversity of gender, race, age, ethnicity and experience |

| ● | Six of 13 directors, or 46 percent, are women, and five, or 38 percent, are African-American or Latinx. |

| ● | All three standing board committees and one special committee are chaired by women |

| ● | Demonstrated refreshment of the Board, with four new directors elected in less than three years and four retirements in last five years |

| ● | Two recently elected directors now serving as chairs of the Audit and Nominating and Governance Committees |

| ● | Active and robust director succession process is on-going, with focus on identifying additional skills needed on the Board |

Sanderson Farms | 2021 Proxy Statement xi

| ● | Lead Independent Director with active role and authority, including representing the Board to our stockholders and facilitating communication between the Board and management |

| ● | Review and discussion of our strategic plan at least annually, and on-going oversight of development and implementation of the plan with consideration of ESG matters |

| ● | Discussion and monitoring of executive officer succession plans throughout the year under the Board’s written management and CEO succession policies |

| ● | Candid and in-depth Board self-assessments annually, with individual self-assessments for directors before re-nomination |

| ● | Rigorous director education program including an in-depth “teach-in” session every April, director visits to our poultry complexes, and reimbursement of fees for corporate director seminars |

| ● | Ongoing oversight and monitoring of enterprise risk and risk management |

| ● | Stock ownership guidelines encourage directors to hold 4,000 shares of our stock |

| ● | Directors engage with our senior management team, “next generation” company managers, and other Company personnel on an on-going basis, both inside and outside the boardroom |

Governance and Disclosure Highlights

| ● | Written corporate governance principles reviewed and reassessed by the Board annually |

| ● | Majority voting for directors |

| ● | Holders of 10 percent of our common stock may demand a special meeting of stockholders |

| ● | Proxy access by-law with standard “3/3/20/20” structure |

| ● | No poison pill |

| ● | Special board committee on DEI appointed in 2020 to provide board-level oversight of all aspects of DEI and engage an outside consultant to conduct Company-wide review of DEI practices |

| ● | New annual lobbying activity and expenditure report published on Company website |

| ● | No Company political action committee (PAC); corporate policy prohibits the Company from endorsing political candidates, making independent expenditures advocating for or against candidates, and making contributions to PACs formed to benefit a particular candidate or political party |

| ● | Insider trading policy prohibits: |

| o | pledging of Company stock without clear demonstration of ability to repay loan without pledged securities; |

| o | hedging transactions; |

| o | purchases on margin; |

| o | purchases and sales of Company stock within six months of each other |

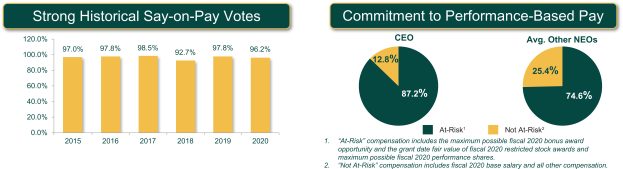

| ● | Annual Say-on-Pay vote |

Sanderson Farms | 2021 Proxy Statement xii

In 2020, as a result of our engagement with several long-term stockholders, we introduced new reporting under the Sustainability Accounting Standards Board (SASB) framework for the meat, poultry, and dairy industry in our annual Corporate Responsibility Report. |

STOCKHOLDER ENGAGEMENT IN FISCAL 2020 | 100+ | Number of one-on-onemeetings with stockholders and investment community | ||||||

Despite the challenges of COVID-19, we conducted an active stockholder engagement program in 2020. When the pandemic made it unsafe to meet in person, we engaged virtually with our stockholders and the investment community to hear their concerns and answer their questions. Topics discussed included the steps we took to protect our workforce from COVID-19 and other human capital matters; our workplace safety culture; our new SASB reporting; DEI; board refreshment; corporate governance and other ESG matters. | 20 | Number of stockholder meetingsattended by Lead Independent Director or other Board leaders | ||||||

| 55 | Percentage of shares represented at stockholder engagement meetings | |||||||

| 9 | Number of non-deal roadshows and investor conferencesmanagement attended | |||||||

| Oct. 16 | Date of Company’s annual investor day(held virtually in 2020) | |||||||

Compensation Highlights

Sanderson Farms | 2021 Proxy Statement xiii

What We Do

| ✓ | Continually set challenging performance targets |

| ✓ | Link pay to relevant performance metrics |

| ✓ | Balance short and long-term incentives |

| ✓ | Prioritize absolute performance across market cycles |

| ✓ | Grant equity-based awards with milestone-based vesting |

| ✓ | Rigorous stock ownership guidelines |

| ✓ | Robust compensation recoupment (clawback) policy |

What We Don’t Do

| X | No options |

| X | No excessive perquisites |

| X | No tax gross-ups |

| X | No hedging or pledging |

| X | No single-trigger change-in-control provisions for executive severance pay |

| X | No excessive golden parachute payments |

| X | No guaranteed bonuses |

Sanderson Farms | 2021 Proxy Statement xiv

Sanderson Farms, Inc.

2021 Proxy Statement

Sanderson Farms | 2021 Proxy Statement xv

PROXY STATEMENT FOR 2018 ANNUAL MEETING OF STOCKHOLDERS

GENERAL QUESTIONS AND ANSWERSThe Sanderson Farms Annual Meeting

Why am I receiving these materials?Information about this Proxy Statement

Our Board is furnishing this proxy statement in connection with the solicitation of Directors is soliciting your proxy for useproxies to vote on matters to be considered at our 20182021 annual meeting of stockholders, towhich will be held exclusively online via a live internet webcast at www.meetingcenter.io/253485236on Thursday, February 15, 201818, 2021, at 10:00 a.m. Central Time, as well as in connection withand at any postponementsadjournment or adjournments of the meeting. The enclosed materials are being mailed to stockholders and postedon-line athttp://ir.sandersonfarms.com/annual-proxy.cfm on or about January 16, 2018.

The annual meeting will be held in the Multi-Purpose Room of our General Corporate Offices, at 127 Flynt Road, Laurel, Mississippi, 39443. You are invited to attend the annual meeting and are requested to vote on the proposals described in this Proxy Statement.

As used in this Proxy Statement, “we,” “us,” “our,” “Sanderson Farms” or the “Company” refers to Sanderson Farms, Inc.

What is included in these materials?

These materials include:

The Annual Report is not to be considered part of the proxy solicitation materials.

What items will be voted on at the annual meeting?

Stockholders will vote on the following items at the annual meeting:

The Board recommends that you vote your shares FOR:

In addition, if presented at the annual meeting, the stockholders will be asked to vote on stockholder proposals to:

The Board recommends that you vote your shares AGAINST both stockholder proposals, if presented at the annual meeting.

1

Will there be any other matters considered at the meeting?

Only those matters that are properly before the meeting pursuant to ourBy-Laws will be considered. As of the date of this Proxy Statement, we are not aware of any matters to be presented other than those described in this Proxy Statement or those incident to the conductpostponement of the meeting.

Where areThroughout this proxy statement, unless the Company’s principal executive offices located, and what is the Company’s main telephone number?

Our principal executive offices are located at 127 Flynt Road, Laurel, Mississippi, 39443, and our telephone number is(601) 649-4030.

Who may vote at the annual meeting?

Only stockholders of record as of the close of business on December 21, 2017, the record date for the annual meeting, are entitled to receive notice of, and to vote at, the annual meeting.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you by mail.

Beneficial Owner of Shares Held in Street Name. If you hold your shares in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account.

If I am a stockholder of record of the Company’s shares, how do I vote?

Stockholders of record have four ways to vote:context shows otherwise:

references to the “Board” or the “Board of |

references to the |

references to “we,” “us,” “our,” the |

If I am a beneficial owner of shares held in street name, how do I vote?Matters to be Voted on at the Annual Meeting

If your shares are held inThe following table describes the name of a broker, bank or other nominee, you will receive instructions from your broker, bank or other nominee that you must follow in order for your broker, bank or other nomineematters to vote your shares according to your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions via the Internet or over the telephone. If you are a beneficial owner of shares held in street name and you wish to vote in personbe considered at the annual meeting, you must obtain a legal proxy from the organization that holds your shares.

How do I vote my shares held in the Company’s ESOP?

If you participate in the Sanderson Farms, Inc. and Affiliates Employee Stock Ownership Plan (the “ESOP”), you will receive a voting instruction form from the ESOP on which you may instruct the ESOP trustee how to vote your shares held in the ESOP. Under the terms of the ESOP, all allocated shares of the Company’s common stock held by the ESOP are voted by the ESOP trustee, as directed by plan participants. All unallocated shares of the Company’s common stock held by the ESOP and allocated shares for which no timely voting instructions are received are voted by the ESOP trustee in the same proportion for and against proposals as shares for which the trustee has received timely voting instructions, subject to the exercise of the trustee’s fiduciary duties.The deadline for returning your voting instruction form is February 5, 2018.

2

Who may attend the annual meeting?

The annual meeting is not open to the public. Only stockholders of record and beneficial owners of shares held in street name, or their respective proxies duly authorized in writing, as well as invited guests, may attend the meeting.

As discussed above, stockholders of record may vote their shares in person at the meeting. Beneficial owners of shares held in street name must obtain a legal proxy from the organization that holds their shares in order to vote their shares in person at the meeting.

What is the quorum requirementrequired for the annual meeting?

The holders of a majority of the shares entitled to vote at the annual meeting must be present in person or by proxy at the annual meeting for the transaction of business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against or abstained, if you:

If a quorum is not present, the annual meeting will be adjourned until a quorum is obtained.

How are proxies voted?

All valid proxies received prior to the annual meeting will be voted. All shares represented by a proxy will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon,adopted, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not give specific voting instructions?

Stockholderstreatment of Record. If you are a stockholder of recordabstentions and you:

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presentedbroker non-votes for a vote at the annual meeting. As of the date of this Proxy Statement, we have not received notice and we are not aware of any business to be transacted at the meeting other than the matters listed on the Notice and described in this Proxy Statement.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then the organization that holds your shares may generally vote your shares in its discretion on routine matters, but it cannot vote onnon-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on anon-routineeach matter, the organization that holds your shares will not have the authority to vote, and therefore cannot vote, on that matter with respect to your shares. This is generally referred to as a “brokernon-vote.” The election of directors (Proposal No. 1), thenon-binding advisory vote on the compensation of our Named Executive Officers (Proposal No. 2), and the shareholder proposals (Proposal No. 4 and Proposal No. 5) arenon-routine matters, so brokers may not vote your sharesBoard’s recommendation on Proposals 1, 2, 4 or 5 if you do not give specific instructions on how to vote. We encourage you to provide instructions to your broker or nominee regarding the voting of your shares on these proposals.

The ratification of the independent auditors (Proposal No. 3) is the only matter that will be considered routine. Because brokers can exercise discretionary voting power on this matter, no brokernon-votes are expected to occur in connection with Proposal No. 3.

Assuming a quorum is present at the annual meeting, what vote is required for each of the proposals to be adopted?

Under ourBy-Laws, a nominee for election as director must receive the affirmative vote of the holders of a majority of the shares entitled to vote and represented (whether in person or by proxy) at the annual meeting. For any other proposal to be adopted at the annual meeting, more votes must be cast in favor of the proposal than votes cast against it.

How are brokernon-votes treated?

Brokernon-votes are counted for purposes of determining whether a quorum is present. However, brokernon-votes are not counted for purpose of determining the number of votes present or represented by proxy and entitled to vote with respect to a particular proposal, thus we believe they will have no effect on the vote on any matter at the meeting.

3

How are abstentions treated?

Abstentions are counted for purposes of determining whether a quorum is present, and they are considered present for the purpose of determining the number of votes present or represented by proxy and entitled to vote with respect to a particular proposal. Abstentions will have the effect of a vote AGAINST in the election of directors (Proposal No. 1), and will have no effect on the vote on the other proposals.

Can I revoke or change my vote after I have voted?

Even if you submit a proxy, you may still attend the annual meeting in person, and you may revoke your proxy by voting in person at the meeting. You may also revoke your proxy before it is voted at the meeting in any of the following ways:

Unless you revoke your proxy, it will be voted at the meeting according to your instructions, as long as you have properly completed and submitted it to us.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the annual meeting if you obtain a legal proxy from the organization that holds your shares.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by the inspector of election and published in a Current Report on Form8-K, which we are required to file with the SEC within four business days after the annual meeting.

Our authorized capital stock consists of 5,000,000 shares ofnon-voting preferred stock, of which 500,000 shares have been designated Series A Junior Participating Preferred Stock, par value $100.00 per share, none of which have been issued, and 100,000,000 shares of voting common stock, par value $1.00 per share, of which 22,828,067 shares were outstanding and entitled to vote as of December 21, 2017, the record date for the annual meeting. Only stockholders of record at the close of business on the record date are entitled to notice of and to vote at the annual meeting. Each such stockholder is entitled to one vote for each share of common stock held at that date.

4

The following table sets forth information, as of January 2, 2018, concerning: (a) the only stockholders known by us to own beneficially more than 5% of our outstanding common stock, which is our only class of voting securities outstanding, (b) the beneficial ownership of common stock of our directors, director nominees and Named Executive Officers, and (c) the beneficial ownership of common stock by all of our directors, director nominees and executive officers as a group. On January 2, 2018, there were 22,829,048 shares of our common stock outstanding.

Unless otherwise indicated, the address of each person named in the table is P.O. Box 988, Laurel, Mississippi 39441.matter:

|

| Required Vote for Approval | Treatment | Treatment | Board’s | ||||||||||||||||||||||||||

1 | To elect four director nominees | ||||||||||||||||||||||||||||||

| a majority of the shares | ||||||||||||||||||||||||||||||

| present in

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| As a vote “AGAINST” | No effect on the vote | FOR Each Nominee | ||||||||||||||||||||||||||||

2 | To approve, in a non-binding advisory vote, the compensation of our named executive officers | Majority of the votes cast | No effect on the vote | No effect on the vote | FOR | ||||||||||||||||||||||||||

3 | Ratification of the appointment of Ernst & Young, LLP as the Company’s independent auditors for fiscal 2021 | Majority of the votes cast | No effect on the vote | No effect on the vote | FOR | ||||||||||||||||||||||||||

4 | |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Majority of the votes cast | ||||||||||||||||||||||||||||||

| No effect on the vote | ||||||||||||||||||||||||||||||

| No effect on the vote | ||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

AGAINST |

| ||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

5Sanderson Farms | 2021 Proxy Statement 1

|

|

6

7

PROPOSAL NO. 1Item 1—Election of Directors

ELECTION OF DIRECTORS

Our amended Articles of Incorporation provide that our Board of Directors shallhas nominated four directors for election at the annual meeting. Each nominee has agreed to be named in the proxy statement and serve if elected. Our Board is divided into three classes, (Class A,and directors in a class are elected at our annual meeting to serve a term of three years until their successors are elected. If re-elected at the annual meeting, the nominees for Class B and Class C), with each class containingdirector will serve until the 2024 annual meeting.

Pursuant to our one-third,by-laws, or as close toone-third as possible, ofthe Board has fixed the total number of directors and that the total number of directors shall be fixed by the Board of Directors in theBy-Laws. TheBy-Laws, as amended and restated as of October 24, 2017, provide the Board of Directors may fix the number of directors from time to time, not to exceed fifteen directors.at 14. The Board has fixed the number of directors at thirteen.

At each annual meeting of stockholders, directors constituting one class are elected for a three-year term. At the 2018 annual meeting, stockholders will elect four Class B Directors, whose terms will expire at the 2021 annual meeting.

Nominees for Class B Directors

The Board of Directors proposes for election as Class B Directors the four nominees listed below, each to serve as a Class B Director until the 2021 annual meeting or until his or her successor is elected and has qualified. Any vacancy on the Board of Directors may be filled either by the Board of Directors or by the stockholders, and under Mississippi law, the term of any director elected to fill a vacancy will expire at the next stockholders’ meeting at which directors are elected.

You may vote proxies in the enclosed form for the election as Class B Directors of only the nominees named below orname substitute nominees who may be named by the Board of Directors to replace any of the named nominees who become unavailable to serve for any reason. No such unavailability is presently knownWe have no reason to the Board of Directors. There are no arrangements or understandings relating tobelieve that any person’s service or prospective service as a Class B Director of the Company. No person listed belownominees will be elected as a Class B Director unless such person receives the affirmative vote of the holders of a majority of the shares entitledunavailable to vote and represented (whether in person or by proxy) at the annual meeting at which a quorum is present. If more persons than the number ofserve if elected. Under our Corporate Governance Principles, directors to be elected receive a majority vote, then those persons receiving the highest number of votes will be elected. The Proxyholders named in the accompanying proxy card will vote FOR the nominees listed below (or substitutes as stated above) unless otherwise directed in the proxy. Abstentions by holders of shares entitled to vote and represented at the meeting will be counted as shares present but not voting for the purposes of calculating the vote with respect to the election of Class B Directors and, accordingly, will have the effect of a vote cast AGAINST a director nominee. Brokernon-votes will be treated as not present for purposes of calculating the vote with respect to the election of the Class B Directors, and will not be counted either as a vote FOR or AGAINST or as an ABSTENTION with respect thereto.

The Board expects a Directorare expected to tender his or her resignationtheir resignations if he or she failsthey fail to receive the required number of votes forre-election. The Board’s Corporate Governance Principles provide that the Board shall nominate for election orre-election as Director, and shall appoint persons as Directors to fill vacancies, only candidates who agree to tender, promptly following such person’s failure to receive the required vote for election orre-election, an irrevocable resignation that will be effective upon Board acceptance of such resignation.

The following table lists the nominees for Class B Directors and the year that they began serving as a director. As discussed below, our Board of Directors has determined that each of Ms. Mestayer and Mr. Baker is an independent director under the listing standards of The Nasdaq Stock Market.

Nominees for Class B Director | Age | Director Since | ||||||

John H. Baker III | 76 | 1994 | ||||||

John Bierbusse | 62 | 2006 | ||||||

Mike Cockrell | 60 | 1998 | ||||||

Suzanne T. Mestayer | 65 | 2017 | ||||||

The Board of Directors recommends a vote FOR the election of Ms. Mestayer and Messrs. Baker, Bierbusse and Cockrell.

8

Directors Continuing in Office

The following tables list the Class C and Class A Directors of the Company, whose terms expire at the 2019 and 2020 annual meetings, respectively, and the year that they began serving as a director.

Continuing Director | Age | Director Since | ||||||

Class C (Term expiring in 2019) | ||||||||

Fred Banks, Jr. | 75 | 2007 | ||||||

Toni D. Cooley | 57 | 2007 | ||||||

Robert C. Khayat | 79 | 2007 | ||||||

Dianne Mooney | 74 | 2007 | ||||||

Gail Jones Pittman | 64 | 2002 | ||||||

Class A (Term expiring in 2020) | ||||||||

Lampkin Butts | 66 | 1998 | ||||||

Beverly Hogan | 66 | 2004 | ||||||

Phil K. Livingston | 74 | 1989 | ||||||

Joe F. Sanderson, Jr. | 70 | 1984 | ||||||

BoardDirector Criteria, Qualifications, and Biographical InformationExperience

We have sought director candidates with a diverse range of business, personal, and geographic backgrounds, and the experience and perspective necessary to oversee effectively a multi-state operation of our size and type. The Nominating and Governance Committee and the Board expect each director to have the following minimum qualifications:

| ● | significant business experience and achievement in production, preferably related to agriculture, or in marketing, finance, accounting, or other professional disciplines relevant to the Company; |

| ● | prominence and a highly respected reputation in his or her profession; |

| ● | a global business and social perspective; |

| ● | a proven record of honest and ethical conduct, personal integrity, and good business judgment; |

| ● | a commitment to congeniality with and mutual respect for other members of the Board and management; |

| ● | concern for the long-term interests of our stockholders; and |

| ● | significant time available to devote to Board activities and to enhance his or her knowledge of our industry. |

The Nominating and Governance Committee also considers candidates’ independence and financial literacy, and for incumbent directors, attendance, past performance on the Board, and contributions to the Board and their committees.

Our emphasis on director collegiality is consistent with our company culture. The Board believes that an effective board process depends on mutual trust among directors and a respectful atmosphere that encourages candor. Candid discussion among directors and with management is critical for the Board to properly exercise its oversight responsibility and its decision-making.

Board Diversity and Experience

Although the Board does not have a formal policy on director diversity, with respect to the Board, it has sought to identify director candidates who represent a diverse range of personal and business backgrounds. The Board has identified such persons through directors’ personal contacts inFollowing the local business communities where we operate. Board members currently reflect racialannual meeting, assuming all the nominees are re-elected, 46 percent of our directors will be women and gender diversity.

38 percent will be African-American or Latinx. Our directors have also worked in a variety of fields, including finance, banking, investment management, law, higher education, heavy industry, agriculture, publishing, technology, transportation and brand management.logistics, and telecommunications. We believe our directors’ diverse professional backgrounds and experience have resulted in a highly qualified Board.

Sanderson Farms | 2021 Proxy Statement 2

The Board has also endeavored to identify directors from the various communities in which our operations are located. When searching for candidates for future Board positions, the Nominating and Governance Committee may focus its attention on candidates from areas where our newer plants are located.

Additionally, two of our outside directors, Ms. Cooley and Ms. Mestayer, serve or have served on the boards of directors of other public companies. We believe their other public board service is valuable to our board process and enhances the Board’s risk oversight capability. We expect that when seeking new director candidates, the Board will consider other public board service as an important factor.

Board Tenure

We also dodoes not have a formal policy with respect to director tenure. This flexibility has allowed us and the Board to benefit from balancing the experience and institutional knowledge of our longer-tenured directors with the service of relatively newer directors who have brought new perspectives, skills, and ideas to the board process. This balance has been an asset in managing our Companycompany through the cyclical downturns that characterize our industry. It has ensured that during down cycles, the Board has the benefit of directors who have historical experience with our operations and the fluctuations in our industry.

The Board of Directors recommends that stockholders vote “FOR” each of the nominees. |

Sanderson Farms | 2021 Proxy Statement 3

Below are biographical summaries current as of the date of this proxy statement for each of our director nominees and directors continuing in office.

Nominees for Class B Director (term expiring in 2024)

John Bierbusse Outside Director Age: 65 Director Since: 2006 Committees: Diversity, Equity, and Inclusion | Business Experience: ● Retired Vice President and Manager of Research Administration, from 2002 to 2004, Assistant Manager, Securities Research, from 1999 to 2002, and prior positions from 1987, A.G. Edwards ● Vice President, Duff & Phelps, Inc., from 1981 to 1987 ● 23 years’ experience as an equity research analyst in the packaged food and agri-products industries ● One of the original authors of the NYSE’s Series 86/87 qualification examination required for publishing equity research analysts (committee member 2003-2007) Other Positions: ● Board member, Chamber Music America, an arts service non-profit organization based in New York, NY ● Board member, Third Coast Percussion, a Grammy-award winning quartet based in Chicago, Illinois ● Board member, Riot Ensemble, a contemporary chamber music ensemble based in London, England ● Pro bono consultant to arts organizations in strategic planning, board development, financial forecasting, and executive coaching Education: ● Bachelor of Arts, Northwestern University ● Master of Management, Northwestern University – Kellogg School of Management ● Certified Financial Analyst Experience and Qualifications to Serve on the Board: ● Mr. Bierbusse’s experience as a sell-side equity research analyst brings to the Board substantial expertise in capital markets, strategic analysis, risk oversight, and financial modeling in our industry. ● As a manager, Mr. Bierbusse also has extensive experience in hiring, mentoring, and evaluating finance professionals, which has benefitted the Board in management performance and succession oversight responsibilities. ● He also has managerial experience in compliance and financial regulation, which has been valuable to the Board in evaluating and overseeing compliance risk. |

Sanderson Farms | 2021 Proxy Statement 4

Mike Cockrell Treasurer, Chief Financial Officer, Chief Legal Officer, and Director Age: 63 Director Since: 1998 | Business Experience: ● Treasurer, Chief Financial Officer and Chief Legal Officer of the Company, since 1993 ● Shareholder, Wise Carter Child & Caraway, Professional Association, Jackson, Mississippi, practicing securities and business transaction law, from 1984 to 1993 ● Associate, Nail McKinney Tate & Robinson, CPAs, from 1979 to 1980 Other Positions: ● Chair, National Chicken Council Communication Committee, from 2013 to 2014 ● Member, Board of Directors, Mississippi Manufacturing Association, from 2007 to 2008 ● Numerous directorships over 30 years with various community and philanthropic organizations Education: ● Bachelor of Business Administration, University of Mississippi ● Juris Doctor, University of Mississippi School of Law ● Certified Public Accountant (inactive) Experience and Qualifications to Serve on the Board: ● Mr. Cockrell’s more than 20 years of experience as the CFO of our Company during our significant internal growth, and his management of our financial condition through the cycles of profitability that characterize our industry, provide the Board with a depth of knowledge about our financial management. ● Mr. Cockrell oversees or has a key role in many aspects of our operations and management that are not typical for chief financial officers of public companies, including legal matters, investor relations, corporate responsibility reporting, our grain purchasing strategy, and risk management. He contributes a broad perspective on our operations to the Board process. ● Mr. Cockrell has played a key role in the mentoring and training of our “next generation” of managers, which has assisted the Board in its oversight of management succession issues. |

Sanderson Farms | 2021 Proxy Statement 5

Edith Kelly-Green Independent Director Age: 68 Director Since: 2018 Committees: Audit Nominating and Governance (Chair) | Current Other Public Company Boards: ● Mid-America Apartment Communities, Inc. (NYSE), since 2020 Business Experience: ● Partner, The KGR Group, whose primary interests are investments in quick service restaurant franchises in Memphis, Tennessee, since 2005 ● Vice President-Strategic Sourcing and Supply and Chief Sourcing Officer from 1993 to 2003, FedEx Express, the world’s largest express transportation company and a subsidiary of FedEx Corporation (NYSE) ● Vice President-Internal Audit and Quality, FedEx Corporation, from 1991 to 1993 and numerous other positions from 1977 to 1991 at both FedEx Corporation and FedEx Express ● Interim Chief Executive Officer, Aeroxchange, Ltd., a multi-airline-owned business-to-businesse-marketplace, 2000 ● Director, BULAB Holdings, Inc., a privately held, specialty chemical company, since 2012 ● Senior Auditor, Deloitte, from 1973 to 1977 Past Public Company Boards: ● Applied Industrial Technologies, Inc. (NYSE), from 2002 to 2019 Other Positions: ● Director, Methodist Health Care Systems, Memphis, since 2018 ● Director, Hatiloo Theater, Memphis, since 2014 ● Founding Member, Philanthropic Black Women of Memphis, since 2006 ● Founding Chair and Member, Ole Miss Women’s Council for Philanthropy, since 2000 ● Member, Advisory Board, Baptist Women’s Hospital, since 2011 Education: ● Bachelor of Business Administration, University of Mississippi ● Master of Business Administration, Vanderbilt University ● Certified Public Accountant (inactive) Experience and Qualifications to Serve on the Board: ● Ms. Kelly-Green’s success as an entrepreneur and experience managing a large chain of restaurants in one of our key consumer markets are tremendous assets to our Board in overseeing risks related to marketing and consumer preferences. ● Her professional experience in corporate operations, supply chain management, logistics, public accounting, and auditing complements the skill sets of our Board. ● Ms. Kelly-Green’s service on another public company board for 17 years, including her role as chair of its corporate governance committee, and her service on numerous civic and charitable organization boards, provide our Board with further depth of experience in governance best practices. |

Sanderson Farms | 2021 Proxy Statement 6

Suzanne T. Mestayer Independent Director Age: 68 Director Since: 2017 Committees: Audit (Chair) Nominating and Governance | Business Experience: ● Owner and Managing Principal, ThirtyNorth Investments, LLC, a registered investment advisory firm providing investment management services to individuals, benefit plans, for-profit and non-profit businesses and trusts, since 2010 ● Managing Member, Advisean Partners, LLC, a private investment and business consulting company, since 2008 ● Executive Vice President and President – New Orleans Market, Regions Bank, from 2000 to 2008 ● Partner, from 1983 to 1991, and other positions from 1973, Arthur Andersen & Co. Past Public Company Boards: ● McMoRan Exploration Co. (NYSE), from 2007 to 2013 Other Positions: ● Member, Board of Directors of Pan American Life Insurance Company, since 2017 ● Past Chair and current member, Board of Directors of Ochsner Health System, the largest healthcare system in Louisiana, since 2004 ● Treasurer and member, Board of Trustees of the National WWII Museum, since 2012 ● Former director, Federal Reserve Bank of Atlanta, New Orleans Branch, from 2014 to 2018 Education: ● Bachelor of Science, Louisiana State University ● Certified Investment Management Analyst® ● Certified Public Accountant (inactive) Experience and Qualifications to Serve on the Board: ● Ms. Mestayer’s successful and distinguished career in investment management, banking, and accounting eminently qualify her to serve on our Board. Her professional expertise allows her to contribute a broad skill set to the Board. ● Ms. Mestayer has served on over 20 public and private boards, presiding as chair for seven, and has served on the audit and compensation committees of several organizations. Her governance experience is extremely valuable in matters of board process and oversight. ● Additionally, Ms. Mestayer’s professional and board experience make her an asset to our Board in its oversight of accounting and financial risk, internal controls, and executive compensation. |

Sanderson Farms | 2021 Proxy Statement 7

Directors Continuing in Office

Class C Directors (term expiring in 2022)

Fred L. Banks, Jr. Independent Director Age: 78 Director Since: 2007 Committees: Audit Compensation Nominating and Governance (Vice-Chair) | Business Experience: ● Senior Partner since 2008, and Partner from 2001 to 2008, Phelps Dunbar LLP, Jackson, Mississippi, practicing general commercial litigation ● Presiding Justice from 1999 to 2001, and Justice from 1991 to 1999, Mississippi Supreme Court ● Circuit Court Judge, Hinds and Yazoo Counties, Mississippi, from 1985 to 1991 ● Representative, Mississippi House of Representatives, from 1976 to 1985 ● Managing Partner, Anderson, Banks, Nichols and Leventhal and successor firms, from 1968 to 1985 Other Positions: ● National Board Member, NAACP, since 1982 (chair, legal committee and member of executive, finance, and audit committees) ● Chairman, Mississippi Civil Rights Museum Advisory Commission, since 2014 ● Chairman, Capitol City Convention Center Commission, since 2006 ● Chairman, Community Foundation for Greater Jackson, from 2007 to 2008 Education: ● Bachelor of Arts, Howard University ● Juris Doctor, cum laude, Howard University School of Law Experience and Qualifications to Serve on the Board: ● Mr. Banks’ extensive experience in law as a legislator, judge, and practicing lawyer allow him to provide valuable insight to the Board in overseeing legal risk management and adopting and implementing governance best practices. ● His active legal career in Mississippi, where we are incorporated and have our principal office, makes him eminently qualified to help lead the Board’s Nominating and Governance Committee. ● Mr. Banks has been a leader in numerous civic and philanthropic organizations in Mississippi and nationally. His experience and perspective in the areas of civil rights and equality of opportunity are invaluable to the Board in fulfilling the Company’s social responsibilities. |

Sanderson Farms | 2021 Proxy Statement 8